Demand for semiconductor capital equipment is showing signs of growth in 2024 compared to the slump the industry experienced in 2023. Increasing requirements for artificial intelligence (AI) and electronic devices—including automotive, industrial, and Internet of Things (IoT) applications—drive demand for semiconductors. Demand for capital equipment required to make semiconductors is projected to rise in 2024 before a sharp increase in 2025. Benchmark's grasp of the leading trends in semiconductor capital equipment for 2024 enables us to effectively meet the requirements of our customers engaged in (or seeking) semiconductor capital equipment solutions.

Trend #1: Recovering Demand for Semiconductor Capital Equipment

The growing interest in semiconductors—such as integrated circuits (ICs) and system-on-chips (SoCs) with reduced size, weight, and power (SWaP)—have resulted in devices shrinking in size as they gain functionality. Whether in memory capacity or signal-processing power, semiconductors must provide more for less to be competitive. Semiconductor developers seek capital equipment that is both dependable and affordable to support semiconductor manufacturing for cost-competitive markets. Equipment must be compatible with the latest photomasks and reticles to achieve the circuit densities and microminiature dimensions needed for emerging markets, such as AI and communications devices at millimeter wave frequencies.

The semiconductor world is currently driven by integrating AI into as many devices as possible, with impact across diverse areas. Increasing demand for automotive applications, for example, is not just for autonomous vehicles but for the electrification of vehicles in general, evidenced by growing electric vehicle (EV) sales. Increasing numbers of EVs are boosting demand for gallium nitride (GaN) and silicon carbide (SiC) high-power ICs for those vehicles, along with the test equipment to characterize them.

In addition, electronic materials—such as those used in EV batteries and biomedical equipment—must be checked for flaws to ensure proper operation. Benchmark’s engineering, manufacturing, and test capabilities enable the development of the measurement precision and test solutions needed for these growing automotive applications. By investing in engineering, manufacturing, and test capabilities during the 2023 downturn, Benchmark is well positioned to meet the needs of the expanding semiconductor market.

Trend #2: Rebuilding a Reliable and Secure Supply Chain

Some of the industry impacts during the pandemic (and through the unprecedented semiconductor market allocation) that customers experienced included:

- Lost revenue

- Delays in deliveries

- Quality issues while bringing on alternate sources of supply

- Increased material pricing resulting in increased prices

- Narrowing of profit margins

- Customer turnover

As a result of these supply-related impacts, we see leading companies doubling down on improving supply chain resiliency. Companies are revising and expanding approved vendor lists, evaluating multi-vendor sourcing strategies, and terminating supplier relationships that don’t prioritize supply chain resilience as a core value.

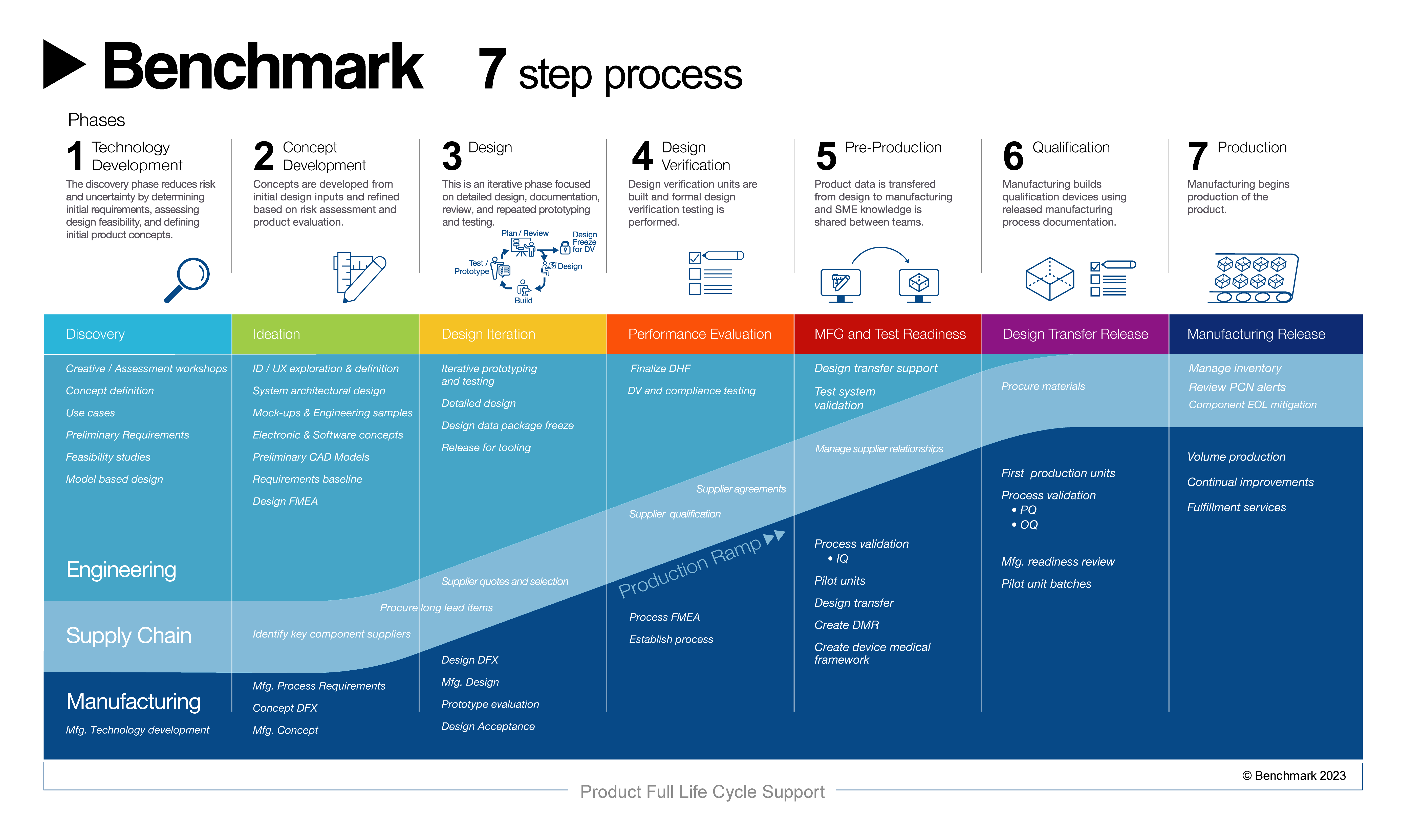

Top semiconductor manufacturers expect their partners to offer global supply chain solutions. These solutions should provide customers with added value, flexibility, security, and cost-efficiency while also maximizing returns on investment. To enhance resilience, customers require their partners to focus on design. During the product design stage, supply chain architects collaborate with design engineers to meet customer needs using preferred supply partners. With more than 400 design engineers, Benchmark can seamlessly include supply chain design early on, during our product realization process.

A robust supply chain contributes to uninterrupted production schedules and helps maintain manufacturing lead times. Supply chain disruptions have plagued electronic manufacturing efforts in recent years, and a reliable supply chain is essential for recovering semiconductor demand starting in 2024. By collaborating closely with our suppliers, Benchmark can effectively manage the required materials for semiconductor device development and manufacturing.

Benchmark uses data-driven systems to maintain a consistent supply chain that cost-effectively meets the customer’s requirements. The systems employ advanced planning and tracking tools and are backed by supply chain services supported by global and regional supplier agreements. By working closely with suppliers and customers, Benchmark strives to maintain supply chain continuity even as demand for semiconductors may fluctuate as market conditions change. Benchmark maintains a global view of a customer's supply chain requirements by connecting its international manufacturing sites through a joint Enterprise Resource Planning (ERP) system.

Trend #3: Supporting New Semiconductor Facilities

Increasing use of intelligent, memory-intensive semiconductors for rapidly expanding global markets such as autonomous vehicles, IoTs, and 5G devices is encouraging major semiconductor suppliers to increase fabrication production facilities.

The increasing demand for higher integration in semiconductor devices coincides with most applications requiring smaller devices and higher-efficiency devices. The increased integration of AI processors, memory, and 5G communications ICs connects a growing number of electronic devices to the internet through IoT devices. This connectivity will drive the demand for semiconductors for years to come. Consequently, there will be a need for an increased number of global semiconductor fabrication facilities to produce the growing number of AI-powered semiconductor devices.

Cutting-edge semiconductor facilities require the latest fabrication and manufacturing equipment to keep pace with the challenges of emerging technologies such as AI. Semiconductor capital equipment must be capable of forming semiconductors with shrinking feature sizes, higher circuit density, and increased energy efficiency. They must also be compatible with the latest semiconductor materials, such as GaN and SiC.

Benchmark’s facility investments in Arizona (Mesa and Tempe), Malaysia, Netherlands, and Romania feature adding capacity and enhanced design, manufacturing, and measurement capabilities. The facilities respect the environment by operating with low carbon-monoxide (CO) emissions. Within Arizona’s growing semiconductor industry, the new Mesa facility is guided by the same management team as Benchmark’s existing Tempe, AZ facility and its Precision Technologies sector to provide continuity and advanced solutions to our semiconductor customers’ most challenging issues.

When It Matters, Turn to Benchmark

Benchmark brings customers a rare combination of engineering innovation, manufacturing agility and precision, and measurement accuracy, requiring a true collaborative partner. As global semiconductor demand recovers and grows in 2024 and beyond, Benchmark offers a broad global footprint that is continuously growing. And, for customers faced with competitive markets, Benchmark’s global facilities support competitive, low-cost requirements.

Benchmark’s supply chain intelligence and close relationships with key suppliers help maintain the material inventories needed to successfully operate our manufacturing facilities worldwide. We meet critical material requirements through multiple supplier agreements while our global manufacturing facilities support stable supply chains through the practical use of our ERP systems. Benchmark’s expanding global manufacturing capabilities provide the added capacity to support growth in the semiconductor capital equipment industry in 2024 and beyond. No matter the anticipated volumes in 2024 onward, semiconductor suppliers can count on Benchmark to enhance the performance of their vital semiconductor capital equipment.

When it matters, turn to Benchmark.