Balancing the Benefits and Challenges of a Changing Competitive Landscape

As the world embraces the many economic and strategic benefits of rapidly advancing computing and communications technologies, we must also prepare for the many associated challenges. 2023 will, indeed, be a year of balance—how well technology corporations harness these promising innovations while also navigating the challenges will ultimately determine their continued success.

Trend #1: The Evolution of Artificial Intelligence

Artificial Intelligence (AI) in and of itself is certainly not new. In fact, depending on whom you ask, AI has now been around for nearly 70 years, having first taken center stage at the Dartmouth Conference in 1956. However, for technology companies, today’s AI challenges are nothing like that of the past.

Technology industry leaders must now strive to meet the demands for increased computational power. This translates into managing the data to create even more intelligent AI while also managing the speed necessary for AI to make logical decisions. However, technology companies must also keep up with continued AI trends, including Generative AI, AI used in autonomous systems, and the increasing pressure for AI democratization. Use cases for these specialized technologies will only intensify in the coming years.

AI and Supercomputers

Today’s automated, data-intensive world is filled with AI applications that require advanced computing systems and supercomputers. However, improving the design and manufacture of a supercomputer’s underlying hardware—such as processors, memory, power supply, storage, and blades—will be paramount for continued success. Investing in specialized hardware profiles will have a considerable impact on both cost and overall algorithm performance. Simply put, the rapid advancement of supercomputers is changing the traditional limits and models in AI technology. With this in mind, tech giants should continue to partner with design and manufacturing specialists to remain successful in a highly competitive landscape.

Trend #2: LEO Satellites—Revolutionizing Global Connectivity

There is little to no argument that Low-Earth Orbit (LEO) satellites will rise to become a fiber contender in both advanced communications and connectivity within the next few years. LEO satellites are generally found at an altitude of 2,000 km (1,240 miles) or less from the Earth’s surface. Unlike geosynchronous (GEO) satellites—satellites that match the Earth’s rotation to be stationary relative to points on the Earth and found at altitudes of 35,000 km (21,700 miles) or higher—LEO satellites are not stationary but rather move quickly with an orbital period of approximately 128 minutes or less. As a result of their lower altitude and ability to continuously revolve around the Earth, LEO satellites:

- Require less energy for placement and less power for transmissions

- Provide higher bandwidth and lower latency communication

- Provide global coverage (and connection to rural and remote communities)

Consider remote areas such as an oil and gas exploration site. To provide internet access to remote sites such as these requires an extensive network of underground cables, fiber ducts, and tower construction for cellular stations. This civil work is not only expensive but very time consuming. Alternatively, LEO satellites can provide virtually ubiquitous internet connectivity with seamless data transfer capabilities even in the most remote locations—and can do so in a matter of weeks as opposed to months or even years. And, because they are closer to the Earth’s surface, their latency delay drops significantly.

Challenges (and Opportunities)

Because of their small field of view, LEO satellites are sent to space in clusters to increase the chances of internet connectivity at any given time. However, these clusters exacerbate an already problematic situation involving space debris, making it harder to safely operate in space, and increasing the chances of space collisions. As a result, the Federal Communications Commission (FCC) has recently released a public draft as a plan to mitigate orbital debris by shortening the time for satellite disposal. While regulations are due to increase in the coming years, LEO satellite technology is also creating business growth opportunities.

Interestingly, telecom operators are starting to consider partnerships with LEO satellite providers to offer mobile broadband connectivity to remote areas. According to Analysys Mason (a global consultancy and research firm specializing in telecoms, media, and technology), these strategic partnerships benefit both parties. While LEO satellite companies will profit by tapping into a pre-existing network of clients, mobile companies will benefit from new revenue growth opportunities. LEO satellite options are also gaining popularity for in-flight connectivity and the Internet of Things (IoT). In fact, Amazon “could use its LEO satellite technology… to track delivery drivers... This would be particularly useful when travelling internationally because it avoids having to switch operators at the border” (Analysys Mason).

Trend #3: Competition Intensifies

While the benefits of emerging LEO satellite technology are promising, there is a particular Achilles heel—occasional visibility obstruction. To achieve uninterrupted satellite internet connectivity, there must be continuous communication (continuous visibility) between the LEO satellites and their ground stations. But LEO transmissions can be comprised either by physical obstructions or in certain weather conditions. As a result, fiber optics is clearly still the frontrunner. As McKinsey & Company puts it:

“Data traffic is expected to expand by around 20 percent annually in the next five years, and fiber is arguably the only fixed-broadband technology currently capable of delivering the speed and capacity expected by governments, businesses, and consumers.”

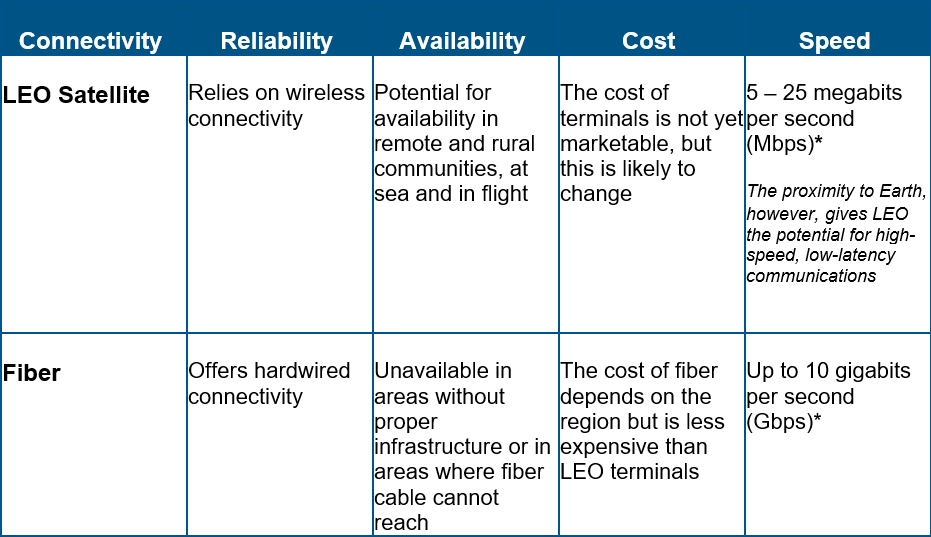

While fiber optics still wins out overall, when we compare reliability, availability, price, and speed, both options have their strongpoints and will likely play a significant role in the future of internet connectivity.

As the competition between GEO and LEO satellites intensifies, new opportunities for mergers and acquisitions will undoubtedly increase. Additional companies will also enter the satellite internet market, creating a more competitive landscape. In turn, tech giants wishing to remain ahead of the competition will require smarter, more efficient designs coupled with the ability to scale with high-volume production.

Benchmark—When AI and Connectivity Matter

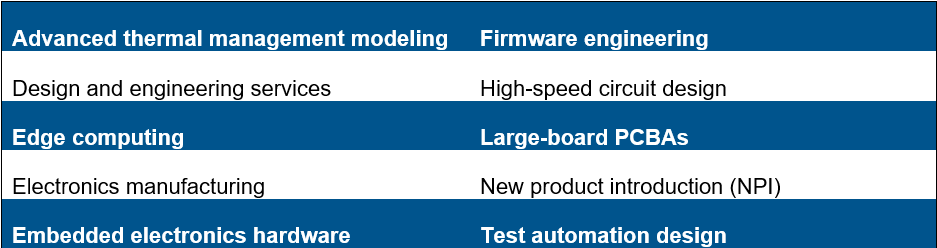

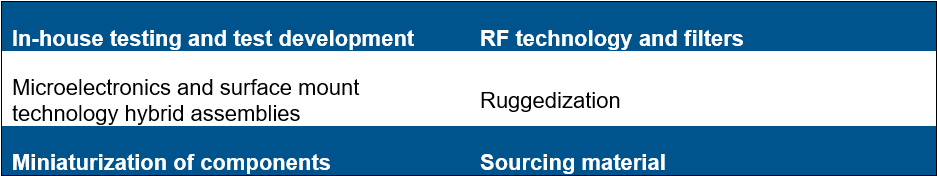

When it comes to supporting our partners within the supercomputer market, Benchmark’s design engineering and manufacturing teams lead the way. With over 40 years of experience as a trusted partner and solutions provider, Benchmark provides a full suite of services, including:

With our established global footprint, Benchmark is strategically positioned to meet aggressive production schedules to help our customers deliver some of the world’s fastest supercomputers.

Benchmark—When Satellite Systems Matter

Benchmark provides electronics manufacturing, design, and engineering services to our original equipment manufacturing (OEM) partners of communication equipment worldwide. Our engineering and manufacturing experts design and deliver satellite systems that help people connect anywhere in the world—land or sea, rural or urban. We also build free space optics (FSO) modules. As the need for FSO in satellite-to-satellite communications increases, Benchmark can support the development of your FSO systems and sub-systems.

Benchmark’s team of engineers—along with our global production facilities—ensure your critical satellite systems can withstand the extreme temperatures and hostile environments in space to help your products last throughout their intended lifetime.

Our specialized teams continuously meet the complex demands of SATCOM and space and meet you where you need us most:

When it matters, connect with Benchmark.